Last Updated on 2 hours by admin

Hyundai Duty Free launches an AI-powered beauty experience in Seoul, reflecting a broader shift toward data-driven, experience-led travel retail.

In a year when travel retail is shifting rapidly from discount-led to experience-driven engagement, Hyundai Duty Free’s launch of an AI-powered beauty experience zone at its Trade Center store in Seoul isn’t just a novelty — it’s a data-backed strategic response to deep structural trends in duty-free retail and beauty commerce.

A Growing Market Undergoing Transformation

The global duty-free and travel retail market remains a substantial economic engine for airports, downtown shops, and travel hubs.

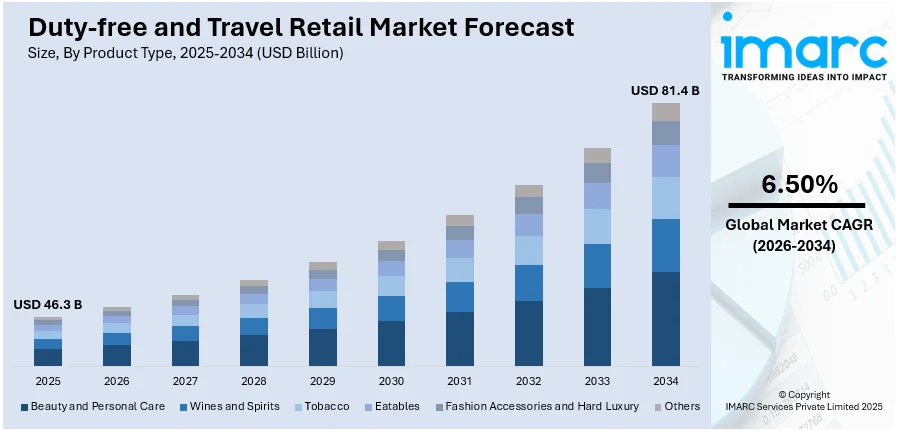

- The global duty-free and travel retail market size was valued at USD 46.3 Billion in 2025, forecasted to reach USD 81.4 Billion by 2034 at a CAGR near 6.5%.

- Within this, perfumes and cosmetics account for roughly 36% of total duty-free sales, making beauty one of the largest and most lucrative categories.

- The Asia-Pacific region dominates both travel volume and duty-free retail share, capturing over 50% of the market.

Meanwhile, the travel retail cosmetic segment alone — largely sold duty-free — is forecast to expand from an estimated USD 28 billion in 2023 toward USD 41 billion by 2032.

Global duty-free beauty/cosmetics share (Mordor Intelligence)

Why Hyundai Duty Free Is Doubling Down on Tech

Traditional duty-free retail has historically emphasized low prices and brand portfolios to capture impulsive high-spend travelers — especially Chinese outbound tourists prior to pandemic-era demand fluctuations. But that model is fracturing according to Vogue report:

- Downtown duty-free beauty sales in Asia-Pacific declined ~10 % YoY in 2024, primarily due to shifts in tourist composition and reduced discount-driven shopping.

- At the same time, airport and experiential formats are outperforming as brands look to re-engage global travelers in more immersive ways.

The Hyundai Duty Free AI beauty zone, TWINIT, launched at its flagship Trade Center branch in Seoul, responds to these dynamics by replacing transaction-first retail with personalized digital consultations that:

- Analyze a visitor’s skin and makeup needs using AI

- Recommend tailored products rather than generic bestsellers

- Help consumers make purchase decisions with data-driven confidence

This aligns with wider beauty-tech adoption trends — where personalization is shown to increase conversion and basket value in digital and physical retail alike.

Strategic Implications for Travel Retailers and Brands

1. From Discount to Discovery

AI diagnostics and interactive experiences are no longer optional extras — they are tools that help duty-free shops compete with e-commerce and domestic beauty retail. With travelers increasingly valuing personalization, tech-enabled experiences become a differentiator, not just a gimmick.

2. Reinforcing Downtown Duty-Free Relevance

Unlike airport shops that benefit from compulsory foot traffic, downtown duty-free stores must justify visitation. Digital experiences like AI beauty analysis help create reasons for travelers to choose a location, not just a price tag.

3. Data as a Retail Asset

AI tools generate first-party insights on preferences, skin types, and purchase intent — enabling:

- Personalization across channels

- Smarter inventory and merchandising decisions

- Targeted promotions during peak travel seasons

Retailers who harness this data can optimize assortments and cross-sell more effectively than competitors relying on static planograms.

Travel Retail’s Reinvention Is Already Underway

Industry insiders describe the current moment as a pivot away from discount-driven duty-free toward curated, brand-forward retail. Global beauty companies and airport operators are experimenting with digital tools such as virtual try-ons, AI consultants, and omnichannel pre-order models to retain share in a competitive landscape.

What This Means for Korea Travel

For Seoul and Korea travel marketing:

- Hyundai Duty Free’s initiative enhances the city’s positioning as a beauty innovation hub

- It reinforces Gangnam’s role as a lifestyle destination, not just a transit point

- It attracts tourists who prioritize experience + discovery over pure price

It also signals to beauty brands that travel retail remains a strategic channel — but one where engagement and personalization now drive value more than mere presence or price.

Bottom Line

Hyundai Duty Free’s AI beauty experience is more than a new retail gimmick. It represents a strategic pivot that aligns with:

- A growing global duty-free market worth tens of billions of dollars

- The increasing share of beauty & cosmetics as core drivers of revenue

- The necessity of digital personalization in physical retail environments

For travel retailers, beauty brands, and regional tourism authorities alike, this launch is a signal of where the duty-free market is headed — and how to unlock its next phase of growth.

Related Posts

10 total views, 10 views today