A Dubai-inspired dessert has gone viral in South Korea, reshaping café menus, retail sales, and ingredient prices amid a broader consumer slowdown.

A Dubai-inspired dessert has unexpectedly become one of South Korea’s most talked-about food trends, reshaping café menus, retail strategies, and even ingredient markets. What began as a niche luxury dessert circulating on social media has evolved into a nationwide phenomenon—highlighting how viral culture now translates directly into economic impact.

Known locally as the “Dubai chewy cookie” or “Dujjonku,” the dessert combines pistachio cream, shredded pastry, and a dense, chewy texture reminiscent of Korean rice cakes. Since late 2025, the Dubai dessert trend in South Korea has spread rapidly across cafés, convenience stores, and even restaurants not traditionally associated with sweets.

From Viral Influencer Post to a Nationwide Dessert Trend in Korea

The rise of the Dubai chewy cookie underscores the speed at which food trends now travel in Korea’s digitally driven consumer culture.

Interest surged after Korean celebrities and influencers shared photos of Dubai-style desserts on Instagram in late 2025. Within weeks, the dessert appeared in Seoul cafés, accompanied by long lines and sold-out notices. By early 2026, related hashtags had surpassed 30,000 posts, turning the dessert into a must-try item for Gen Z and young millennials.

Unlike traditional cookies, the Dubai chewy cookie’s cross-section—oozing pistachio filling wrapped in a visually striking dough—made it particularly well suited to short-form video platforms. The dessert’s success reflects how visual shareability has become as important as taste in driving demand.

How the Dubai Dessert Trend Spread Across South Korea (2024–2026)

From a niche luxury viral moment to a nationwide retail phenomenon.

Dubai chocolate gains global attention on TikTok and Instagram.

Korean influencers and celebrities begin posting Dubai-style desserts.

“Dubai chewy cookie (Dujjonku)” appears in specialized Seoul cafés.

Trend spreads nationwide; prices rise and shortages emerge in major cities.

Convenience stores and franchise restaurants adopt Dubai-inspired flavors.

How the Dubai-Inspired Dessert Trend Is Affecting Prices and Supply Chains in Korea

The popularity of the Dubai-inspired dessert has had measurable economic consequences, particularly in ingredient markets.

Rising Ingredient Costs

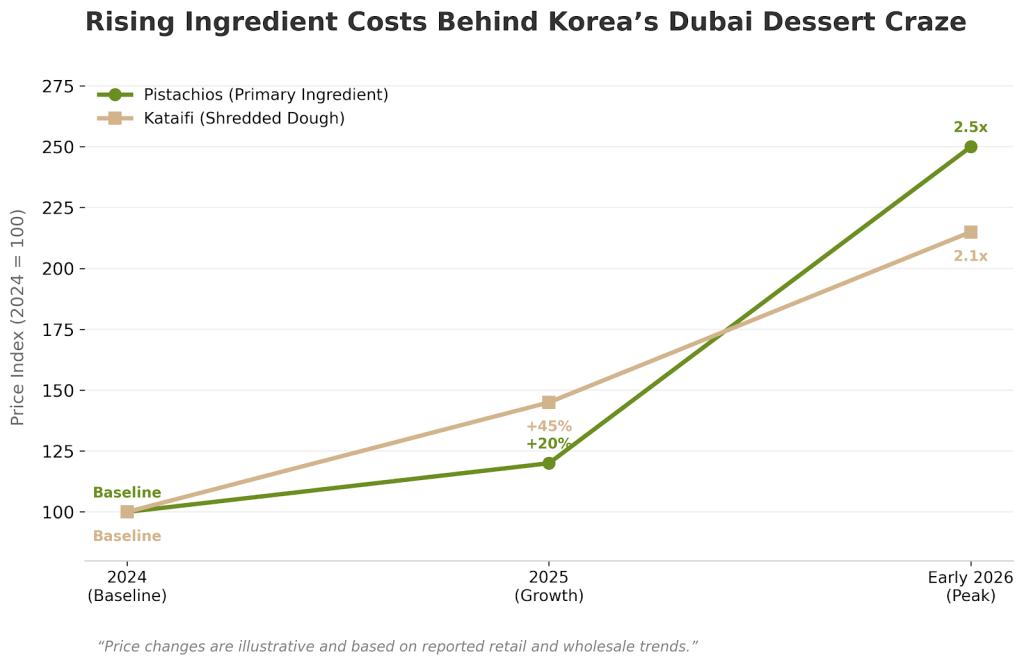

Pistachios, a core component of the dessert, have experienced sharp price increases:

- Retail prices for shelled pistachios in Korea rose around 20% year-over-year, climbing from roughly ₩20,000 to ₩24,000 per 400 grams.

- Price-tracking platforms reported that pistachio prices more than doubled—and in some cases tripled—during peak demand periods in early 2026.

Imported shredded dough (kataifi), another key ingredient, has also become harder to source consistently, adding further pressure to café margins.

As a result, Dubai chewy cookies now typically sell for ₩8,000–₩10,000 per piece, placing them firmly in premium dessert territory.

Retail and Café Strategies: Loss Leaders and Trend Chasing

Despite rising costs, many businesses see strategic value in carrying the dessert.

Some cafés continue to sell the cookie at slim margins—or even at a loss—using it as a traffic-driving loss leader. Restaurants with no prior focus on desserts, including noodle shops and casual dining spots, have added Dubai-style sweets to attract younger customers and boost visibility on delivery apps.

At the same time, convenience store chains have moved quickly to adapt the trend. Dubai-inspired products and related pistachio-based snacks have recorded strong sell-through, demonstrating how viral café trends can rapidly migrate into mass retail.

However, not all businesses have benefited. Several small cafés have announced plans to discontinue the dessert once existing ingredient stock runs out, citing unsustainable costs despite strong demand.

Why the Dubai Dessert Craze Matters Beyond Food Trends

While the Dubai chewy cookie may appear to be a fleeting food fad, it reflects deeper shifts in South Korea’s consumer and retail landscape.

1. Social Media as an Economic Driver

The trend illustrates how viral exposure can now influence real-world pricing, inventory decisions, and supply chains within months—not years.

2. Global Trends, Local Impact

What started as a Middle Eastern luxury dessert and global TikTok trend has directly affected Korean retail prices, highlighting the growing interconnectedness of global food culture and local markets.

3. Retail Adaptation in a Slow-Growth Environment

With Korea’s retail sector facing muted growth, trend-driven products offer a rare opportunity to stimulate foot traffic and short-term sales—even at the expense of margins.

The Bigger Picture: A Case Study in Viral Consumption

The Dubai-inspired dessert trend in South Korea is less about sugar and more about structure. It shows how modern consumption operates at the intersection of social media visibility, cultural participation, and retail economics.

For consumers, the cookie represents novelty and social currency.

For businesses, it’s a high-risk, high-attention product.

And, for the broader market, it’s a reminder that viral demand can reshape pricing and supply chains almost overnight.

Whether the Dubai chewy cookie fades or evolves into a longer-term category, its rise offers a clear lesson: in today’s market, attention is not just cultural capital—it’s economic power.

Related Posts

1,071 total views, 6 views today