Last Updated on 5 months by admin

Korea tourism policy 2025 introduces visa-free entry, fiscal spending, and innovation. What South Korea tourism incentives mean for the industry.

South Korea is setting ambitious targets for its tourism sector in 2025 and industry players will need to adapt quickly if they want to benefit.

According to the Korea Tourism Organization (KTO), the country aims to attract 18.5 million foreign visitors in 2025, a 13% increase over last year. To hit that goal, the government is rolling out a mix of policy changes, visa reforms, and strategic projects. They are designed to boost arrivals, extend visitor stays, and raise per-capita spending.

But these aren’t just abstract numbers. Every incentive carries ripple effects for airlines, hotels, and SMEs across the tourism ecosystem.

Tourism as a Strategic Industry Under the New President

The election of President Lee Jae-myung in June 2025 has added political weight to these initiatives. Lee has pledged to elevate tourism into a strategic industry, promising greater policy coherence after years of fragmented initiatives.

His administration has committed to a bold fiscal expansion post the marital law crisis. It includes more than $14 billion in new spending to revive domestic demand and reinforce export sectors like tourism. That means airlines, hotels, and SMEs should expect not just marketing campaigns, but also infrastructure investment and subsidies to sustain growth.

Visa-Free Entry and Airline Load Factors

One of the boldest steps announced this year is the decision to grant temporary visa-free entry to Chinese visitors in the second half of 2025. Given that China was historically Korea’s largest inbound market, this policy could dramatically lift passenger demand on Korea–China routes.

In 2024, 16.4 million travelers visited South Korea, almost 48% more than 2023 and 17.5 million in 2019 (before pandemic). And Chinese nationals contributed to the largest share, 28%, according the Korean government data.

For airlines like Korean Air and Asiana, the incentive offers a chance to regain market share and boost load factors. Smaller carriers and SMEs in package tours will face stiffer competition and thinner margins unless they differentiate with tailored services.

Hotels and Regional Tourism Opportunities

Beyond entry policy, the KTO has announced eight key projects for 2025 under its vision of reaching “the era of 20 million foreign tourists.” These include major pushes into regional tourism, K-culture events, and smart tourism infrastructure.

This matters for the hotel sector. Growth will no longer be concentrated in Seoul alone. Secondary cities like Busan, Gyeongju, and Jeju are expected to see surges in demand. The incentives are designed to disperse visitors and reduce pressure on the capital. Hotels, guesthouses, and regional operators that align with digital booking platforms and experiential tourism trends will capture outsized benefits.

President Lee’s AI and innovation agenda also creates opportunities here. His government has had named AI investment a top priority, not just for manufacturing but for cultural exports such as K-beauty, K-food, and K-content. Hotels and travel operators using AI personalization and digital guest experiences will be well placed to benefit.

SMEs and the Competitive Squeeze

South Korea’s “Metropolitan Visa System”, launched in 2025, also empowers local governments to tailor visa policies to attract tourists directly to their cities. For SMEs, from boutique tour operators to F&B businesses, this creates both opportunities and challenges.

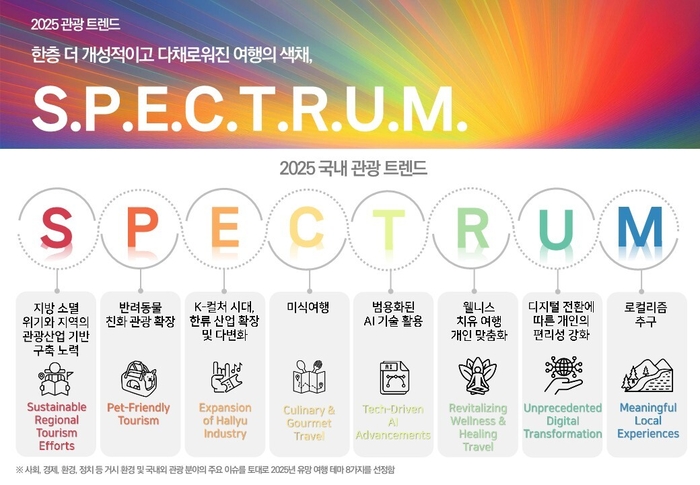

On one hand, SMEs gain visibility through targeted regional marketing campaigns and easier inbound flows. On the other, they risk being sidelined if they fail to adopt digitalization, sustainability practices, and multilingual customer service. These are all highlighted as 2025 mega-trends in the tourism sector.

With the Lee government’s expansionary fiscal policy, SMEs may gain new subsidies or infrastructure funding. They must align with cultural, tech, and sustainability priorities to qualify.

The Bottom Line

South Korea’s 2025 tourism incentives, from visa-free entry for Chinese travelers to regional development projects, are not just about boosting visitor counts. They are signals to the market: adapt, innovate, and scale, or risk being left behind.

With President Lee Jae-myung reframing tourism as a national strategic industry, the stakes are higher than ever. Airlines must plan capacity growth sustainably. Hotels must invest in digital ecosystems and experiential offerings. SMEs must embrace innovation and regional diversification.

The government has put the pieces on the board. Now it’s up to industry leaders to move decisively.

3,886 total views, 1 views today